We live in a time when convenience, efficiency, and accuracy are highly valued. Digital technology has transformed practically every area of our lives, from smart home gadgets that ease our daily routines to corporate software that converts our operations. This trend is most visible in the payroll management industry. If you’re still dealing with convoluted spreadsheets, manual data input, and the stress of end-of-month payroll computations, it’s time to say goodbye to payroll headaches. In this article, we will look at the world of paystub generators, why it is the future of payroll management, and how it may alter your business operations.

The Evolution of Payroll Management

Let’s take a trip down memory lane to better grasp the value a paystub generator may bring to your company. Payroll management has always been a time-consuming and error-prone operation. It entailed entering and double-checking data, calculations, taxes, benefits, and deductions, among other things. The introduction of spreadsheet software like Excel made things more manageable over time, but the procedure was still time-consuming and prone to errors.

Then the first payroll software systems appeared. While these early systems were a big step forward, they frequently required expensive hardware, proprietary software, and specialized training. However, payroll systems, like all technology, have evolved. Enter the era of online payroll systems, which are adaptable, user-friendly, and accessible from any location. Paystub generators represent the pinnacle of this progression. You can use a generator to simplify your payroll management process without incurring financial costs. Try the paystub generator free version and enjoy its simplicity and efficiency.

Why You Need a Paystub Generator

There are several strong reasons to consider switching to a check stub generator. Here are some of the most important:

Saves Time

Automation saves time. By streamlining the payroll process, you may save time on payroll administration and focus more on the essential parts of your organization.

Reduces Errors

Manual data entry is a major source of payroll errors, which can result in disgruntled employees and potential legal difficulties. A paystub generator minimizes this risk by consistently producing consistent and accurate pay stubs.

Enhances Transparency

A paystub generator records each employee’s pay information, including taxes, deductions, and net pay. Transparency can boost trust and engagement in your staff.

Offers Convenience

You may access your payroll data anytime and anywhere with cloud-based check stub generators. With a few clicks, you can generate pay stubs, make adjustments, and manage payroll responsibilities from your computer or mobile device.

Improves Compliance

Paystub generators are designed to stay up with the most current tax rules and regulations, ensuring that your company meets all legal requirements.

Key Features of the Paystub Generator

The paystub generator has several critical characteristics that make it an excellent payroll management tool:

Customization

You may create pay stubs with your company logo, colors, and branding with the check stub generator. This gives a professional touch and enhances the identity of your organization.

Flexible Payment Options

A generator can accept various ways and create valid pay stubs whether you pay your employees via direct deposit, paper checks, or other means.

Tax Calculation and Reporting

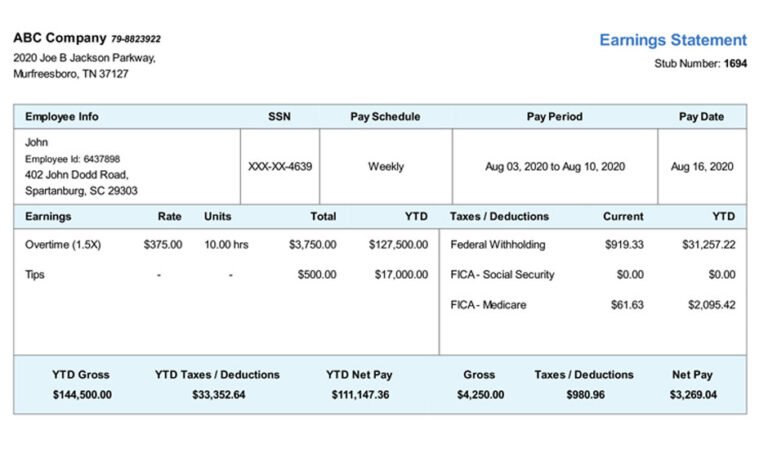

The program calculates and reports taxes automatically depending on the employee’s income, deductions, and applicable tax rates. It creates detailed tax reports, making tax filing and reporting more efficient.

Deductions and Benefits Management

Check stub generator makes managing deductions such as health insurance premiums, retirement contributions, and other employee perks easier. It calculates and displays these deductions precisely on each pay stub.

Employee Self-Service

Some paystub generator systems provide self-service portals allowing employees to view their pay stubs, tax forms, and other payroll-related paperwork. Employees now have simple access to their financial information.

Is the Paystub Generator Free?

While some paystub generators are free, remember that they frequently have limitations in functionality, customization, or the number of pay stubs you may generate. These free versions may be adequate for individuals or small enterprises with limited payroll needs.

However, a premium check stub generator is sometimes advised for companies with complex payroll needs. Paid versions usually include more features, customization choices, specialized customer support, and the ability to handle more significant pay stubs. A paid paystub generator is a worthwhile investment when you consider the time saved, the reduction in errors, and the overall convenience and efficiency it brings to your payroll management.

Consider your company’s specific needs, budget, and the support and features required when selecting a paystub generator. Many companies provide trial periods or demos, allowing you to test the program before purchasing.

Making the Switch

Switching to a paystub generator might be intimidating, especially if you’ve done payroll manually for years. However, it is crucial to remember that most providers endeavor to make the changeover as smooth as possible. They recognize the difficulties of change and provide complete assistance to make the transition easier. These services ensure you have the resources and support to seamlessly adjust to the new system, from assisting with data migration to offering user training.

After successfully implementing a check stub generator, you will likely feel relieved and wonder how you managed payroll without it. Manually entering data, completing complex computations, and double-checking for errors will become a thing of the past. With the generator’s automation and efficiency, you can streamline your payroll management, save critical time, and refocus your emphasis on more strategic elements of your organization.

Furthermore, the check stub generator’s user-friendly features and straightforward layout make it easy to use. Even if you or your staff are not tech-savvy, the software’s detailed instructions and logical workflow make it usable by people of all technical levels. Accepting the paystub generator may take some time, but the benefits it delivers to your payroll administration process will be well worth the first effort.

The Bottom Line

The paystub generator automates operations and eliminates human headaches in payroll management. It saves time, lowers errors, and makes administrative jobs easier. The software effortlessly generates accurate pay stubs with just one data entry.

Accepting the paystub generator implies taking the future of payroll management. It provides convenience, transparency, and tax compliance. The move is seamless because it is accessible from anywhere, adaptable, and includes help for data migration and user training. With the paystub generator, you can say goodbye to payroll headaches and hello to a new era of efficiency.